As the freight industry looks toward 2025, a major shift is unfolding—putting carriers in the driver’s seat after years of freight broker dominance. While brokers have long held leverage with their tech platforms and vast networks, emerging industry trends suggest a market correction—one that’s beginning to favor those who own and operate trucks.

📊 Insights from TQL Insiders

Two high-level sources from Total Quality Logistics (TQL) have confirmed in internal strategy meetings that May–June 2025 marks the beginning of a five-year cycle favoring carriers. This prediction is based on market performance, economic indicators, and declining capacity trends nationwide.

📈 Why the Market Is Favoring Carriers

- Increased Demand for Freight: The post-pandemic economic surge—especially in e-commerce, construction, and manufacturing—is fueling demand for reliable trucking services.

- Tightened Capacity: Many smaller operators exited the market during downturns, creating a supply shortage that gives surviving carriers more pricing power.

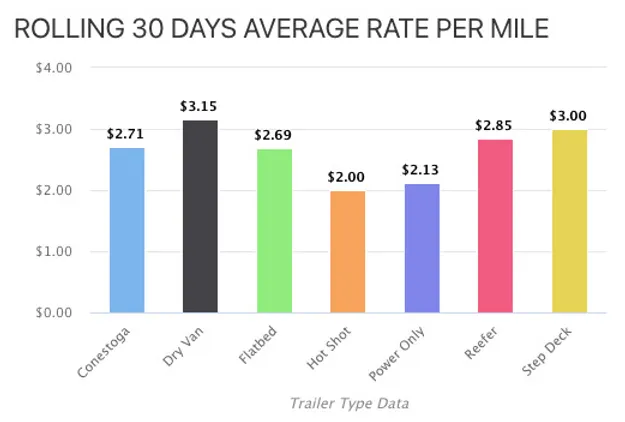

- Freight Rate Growth: Spot and contract rates are climbing as shippers compete for limited capacity. Carriers who build direct shipper relationships are especially positioned to benefit.

- Technological Empowerment: Carriers are using tools like TMS systems to optimize operations, reduce costs, and bypass brokers in securing profitable freight.

🔮 5-Year Market Outlook (2025–2029)

- 2025–2026: Carriers will likely see rapid gains as freight demand intensifies and truck supply stays constrained. Expect freight rates to rise across the board.

- 2027–2029: The market will likely stabilize, but carriers who invest in technology and direct shipper partnerships will continue to outperform brokers.

This new freight landscape presents an incredible opportunity for carriers to take back control and improve profit margins. At Freight Girlz, we’re not just watching the market evolve — we’re helping our carrier partners lead the charge.