Q2 2025: The U.S. Trucking Industry at a Crossroads

Q2 2025: The U.S. Trucking Industry at a Crossroads

How Shifting Trade Policy, Market Volatility, and AI Technology Are Reshaping the Future of Freight

As we enter the midpoint of 2025, the U.S. trucking industry finds itself caught between the remnants of a post-pandemic market correction and the demands of a rapidly evolving global supply chain. What was once considered a cyclical slowdown is now showing signs of structural transformation. Factors like shifting trade policies, warehouse capacity challenges, geopolitical tension, inflation, and an accelerating digital revolution are colliding to redefine how freight is sourced, priced, and delivered across North America.

This expanded Q2 2025 report provides a deep dive into each critical pressure point affecting the freight industry. From front-loading import surges and Mexican nearshoring headaches to fluctuating spot rates and tariff-fueled uncertainty, carriers and brokers are navigating a landscape in flux. And while artificial intelligence is unquestionably reshaping workflows (more on that later), traditional freight fundamentals—cost, capacity, and control—are being tested like never before.

Shippers: Navigating Uncertainty Through Diversification, Warehousing, and Cross-Border Strategy

The first half of 2025 has forced shippers into a defensive posture. With Washington enacting sweeping new tariffs on Chinese and Southeast Asian imports—ranging from a blanket 10% to targeted penalties as high as 60%—many large importers front-loaded Q1 and Q2 inventories. This rush to beat tariff deadlines caused sharp demand spikes in coastal and border-adjacent warehousing markets like the Inland Empire, Laredo, Nogales, Savannah, and Elizabeth, NJ.

However, this surge has led to unintended consequences. Industrial storage rates climbed by double digits in some markets, with Laredo seeing year-over-year lease increases of up to 22%. Inventory overflow forced some shippers to lease overflow yards or divert to second-tier hubs such as McAllen, TX or Tucson, AZ, where infrastructure remains less developed. This bottleneck created inefficiencies across intermodal, drayage, and long-haul operations.

More strategically, shippers have accelerated the diversification of their sourcing networks. Rather than rely solely on Chinese and Vietnamese manufacturing hubs, many are embracing the “China+1” model—sourcing components or finished goods from India, Indonesia, Eastern Europe, or Latin America. But the standout trend is nearshoring to Mexico.

Shifting manufacturing to Mexico provides shippers with faster replenishment cycles, reduced ocean freight costs, and insulation from trans-Pacific disruptions. Yet, this shift is anything but seamless. Cross-border regulations, customs delays, bonded freight complexities, and a shortage of bilingual logistics coordinators are slowing adoption. Additionally, rail capacity between Mexico and the U.S. has not scaled quickly enough to meet new demand, creating chokepoints at Laredo, Eagle Pass, and Otay Mesa.

Capacity: The Great Rebalancing Is Still in Progress

Despite ongoing carrier exits, the U.S. trucking market remains oversupplied. The aftermath of the 2021–2022 equipment buying spree—fueled by government stimulus, pandemic-related rate spikes, and unrealistic market optimism—is still rippling through the industry. Thousands of small carriers and lease-purchase operators flooded the market, often overleveraged and underprepared for a rate reset.

As of June 2025, industry analysts estimate that Class 8 capacity is still 15–18% above pre-COVID equilibrium. Tractor repossessions are up nearly 40% year-over-year, and FMCSA deactivations—particularly among single-truck authorities—have continued at a brisk pace since late 2024. However, this attrition has not yet restored balance. The volume softness, especially in contract dry van and reefer freight, has created intense rate compression and bidding wars.

Large enterprise carriers have taken advantage of the moment. With deeper capital reserves, they’ve renegotiated contracts at scale, deployed drop-and-hook programs to maximize driver utilization, and expanded into struggling mid-sized fleet markets via acquisition or partnership. Some are even engaging in “power only” freight models, reducing their equipment risk while expanding footprint.

Meanwhile, driver turnover rates have moderated—not due to improved working conditions, but from a lack of better opportunities elsewhere. Many drivers who once bounced between small carriers or pursued authority ownership are now returning to larger fleets offering consistent miles, sign-on bonuses, and better fuel and maintenance support.

Contract Rates: Stability with a Side of Hesitation

For the first time since late 2022, contract freight rates have posted a modest year-over-year increase, up 1.4% in Q1 2025. While this technically marks a return to inflationary territory, the improvement is heavily nuanced.

Long-haul dry van and reefer contracts have shown little enthusiasm. Shippers continue to push for agility—shorter rate terms, index-based pricing linked to the spot market, and volume commitments that allow for more frequent rebalancing. The days of multi-year fixed contracts are fading, replaced by rolling quarterly agreements that favor flexibility over consistency.

Infrastructure-related freight—such as flatbed and heavy-haul—has shown more resilience. State-level highway projects, utility infrastructure upgrades, and renewable energy installations are injecting life into these sectors. Still, even flatbed contract rates remain below their 2021 peaks.

LTL (less-than-truckload) and parcel carriers have fared better. The continued rise of e-commerce, even if slowed from pandemic highs, has supported contract freight volumes in those sectors. However, many regional LTL players are facing cost inflation from labor union demands, forcing them to push harder during annual bid cycles.

In short, contract rates in 2025 are less a measure of strength and more a reflection of cautious normalization.

Spot Market: A Fragile Recovery Meets Structural Headwinds

The spot market in Q2 2025 tells a two-sided story: pockets of seasonal strength undermined by structural excess. Spot rates saw a promising 9.1% year-over-year jump in Q1, driven by restocking after Lunar New Year, increased produce volumes out of California and Florida, and Memorial Day retail replenishments. But by late May, momentum stalled.

DAT, FreightWaves SONAR, and Truckstop.com indexes showed steady rate deterioration across major dry van lanes such as Atlanta to Chicago and Dallas to Los Angeles. The problem? Supply continues to outpace demand, and the “quality load” threshold—shipper-paid loads with favorable margins, detention terms, and facility ratings—remains elusive for most.

The refrigerated segment is especially challenged. A surplus of reefer trailers and erratic produce seasons (exacerbated by drought conditions in the Central Valley) have driven down utilization rates. On the other hand, open deck carriers—particularly step-deck and RGN operators—are holding strong thanks to oversize equipment hauls and energy sector demand.

Digital freight brokerages are also applying downward pressure on rates by leveraging tech-driven bidding tools. By sourcing 20–50 bids per load within seconds, they’re forcing small carriers into a race-to-the-bottom pricing dynamic.

Expect more volatility through Q3, especially with looming hurricane threats, shifting tariff rules, and crop cycle variations. The spot market is no longer the “safety valve” it once was—it’s now a high-risk, low-yield environment unless strategically managed.

Tariffs and Trade: A Moving Target with Global Repercussions

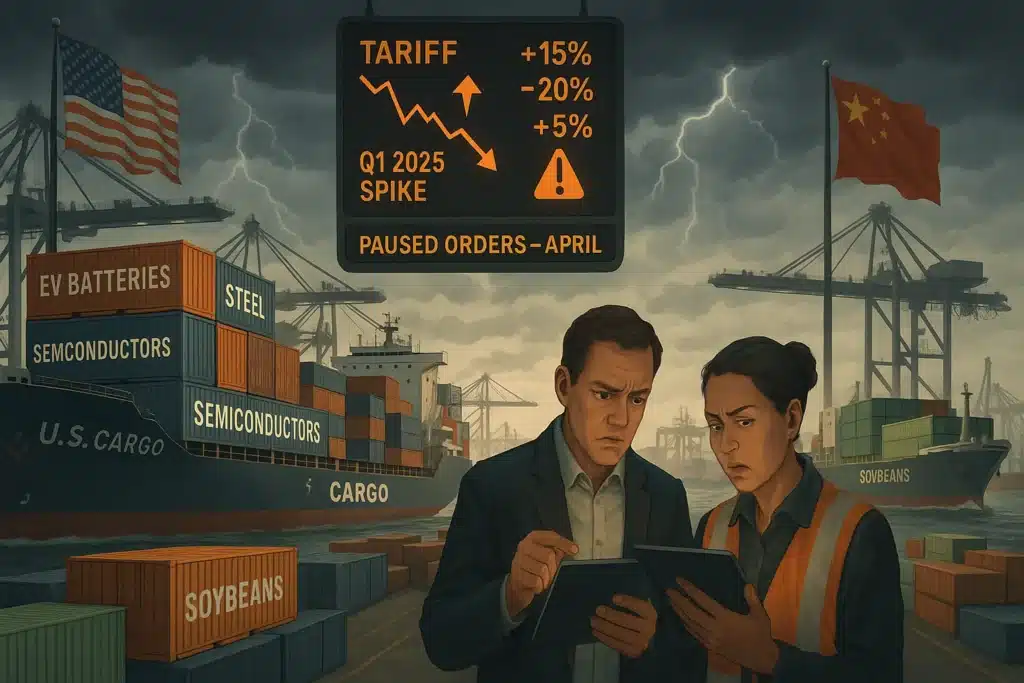

The reimplementation and expansion of tariffs in early 2025 has created a freight environment dictated as much by politics as by economics. The Biden administration’s new tariff schedule—heavily targeting EV batteries, electronics, steel, and semiconductors—has not only strained relations with China but introduced a layer of unpredictability to freight pricing.

Q1 saw a massive pre-tariff spike in U.S. port activity, especially in Los Angeles, Long Beach, Savannah, and Houston. Ocean carriers struggled to keep up with TEU volumes, pushing more shippers toward transloading and near-port warehousing. But this brief surge gave way to stagnation in April and May, as many importers paused new orders to reassess their sourcing strategies.

China’s retaliatory tariffs on U.S. soybeans, tractors, and industrial goods have hit Midwestern exporters particularly hard. Combined with rising marine insurance premiums and tighter customs inspections, this has dampened trans-Pacific trade across both eastbound and westbound routes.

Freight brokers and logistics managers are now being asked to forecast fuel surcharges, container costs, and port drayage rates in geopolitical conditions that change week-to-week. This level of uncertainty is accelerating the need for more agile, diversified supply chains.

Nearshoring and Mexico: A Strategic Pivot with Growing Pains

Mexico has firmly entered the spotlight in 2025 as the leading destination for U.S. nearshoring efforts. Manufacturing hubs around Monterrey, Tijuana, Reynosa, and Saltillo are experiencing explosive growth, with dozens of industrial parks expanding to accommodate the demand from automotive, electronics, and textile companies relocating from Asia.

But logistics professionals warn: growth without infrastructure creates fragility.

Border wait times—already a major concern pre-pandemic—have worsened. CBP staffing issues, limited customs brokers, and deteriorating roads on both sides of the border contribute to multi-hour delays. Delays of 8–12 hours at Laredo and Otay Mesa have become common, reducing equipment utilization and inflating carrier costs.

Security issues have also returned to the forefront. Cartel-related violence and hijacking risks in key Mexican corridors are forcing U.S. fleets to adopt convoy models, use GPS-monitored drayage partners, and implement multi-driver relay handoffs.

Despite these challenges, demand continues to surge. Load boards in the southwest are flooded with Texas-to-Mexico freight, and certified cross-border carriers are now commanding significant premiums. Third-party logistics firms are responding by building dual-nation carrier networks and opening satellite offices in Northern Mexico.

AI and APIs: Transforming Freight Spot Quoting and Carrier Workflows

Artificial Intelligence is revolutionizing transportation at every layer. Shippers are replacing static RFPs with AI-generated spot quotes based on live lane and fuel data. Freight brokers are using API-connected platforms to streamline quoting, carrier vetting, and compliance workflows.

OpenAI-powered copilots now read rate confirmations, highlight risk indicators, and auto-generate pickup instructions—reducing dispatcher workload. Carriers, especially small fleets, are using AI to evaluate load profitability, predict maintenance needs, and avoid bad broker interactions. Factoring firms and insurance underwriters are joining the AI wave to assess payment risk and safety scores in real time.

The Road Ahead: A Pivotal Hinge Point for U.S. Freight

As we head into the second half of 2025, the U.S. trucking and logistics industry stands not at the end of a cycle—but at the beginning of a permanent reordering. Traditional business models based on relationship brokering, long-term stability, and static pricing are being disrupted by automation, geopolitical shockwaves, and the brute-force economics of capacity imbalance.

The winners of Q3 and Q4 won’t be those with the lowest operating ratios or the most trucks—they’ll be those that master adaptability:

- Brokers who retool their platforms into data-rich, API-connected ecosystems.

- Carriers who use AI, not intuition, to make load decisions.

- Shippers who adopt multimodal agility and supply chain resilience as core strategies.

This isn’t merely recovery from a downturn. It’s a reckoning. And only those who embrace transformation—technological, operational, and geopolitical—will be positioned to lead.

Author’s Note:

This expanded Q2 2025 report is built upon verified data and industry reporting from FreightWaves, Trucking Dive, RXO, Loadsmart, Greenscreens.ai, Transporeon, DAT, C.H. Robinson, and confidential interviews with U.S.-based fleet operators and 3PL executives.