Free IFTA Calculator (2026) – Quarterly Fuel Tax Tool

IFTA Calculator — Quarter Filing

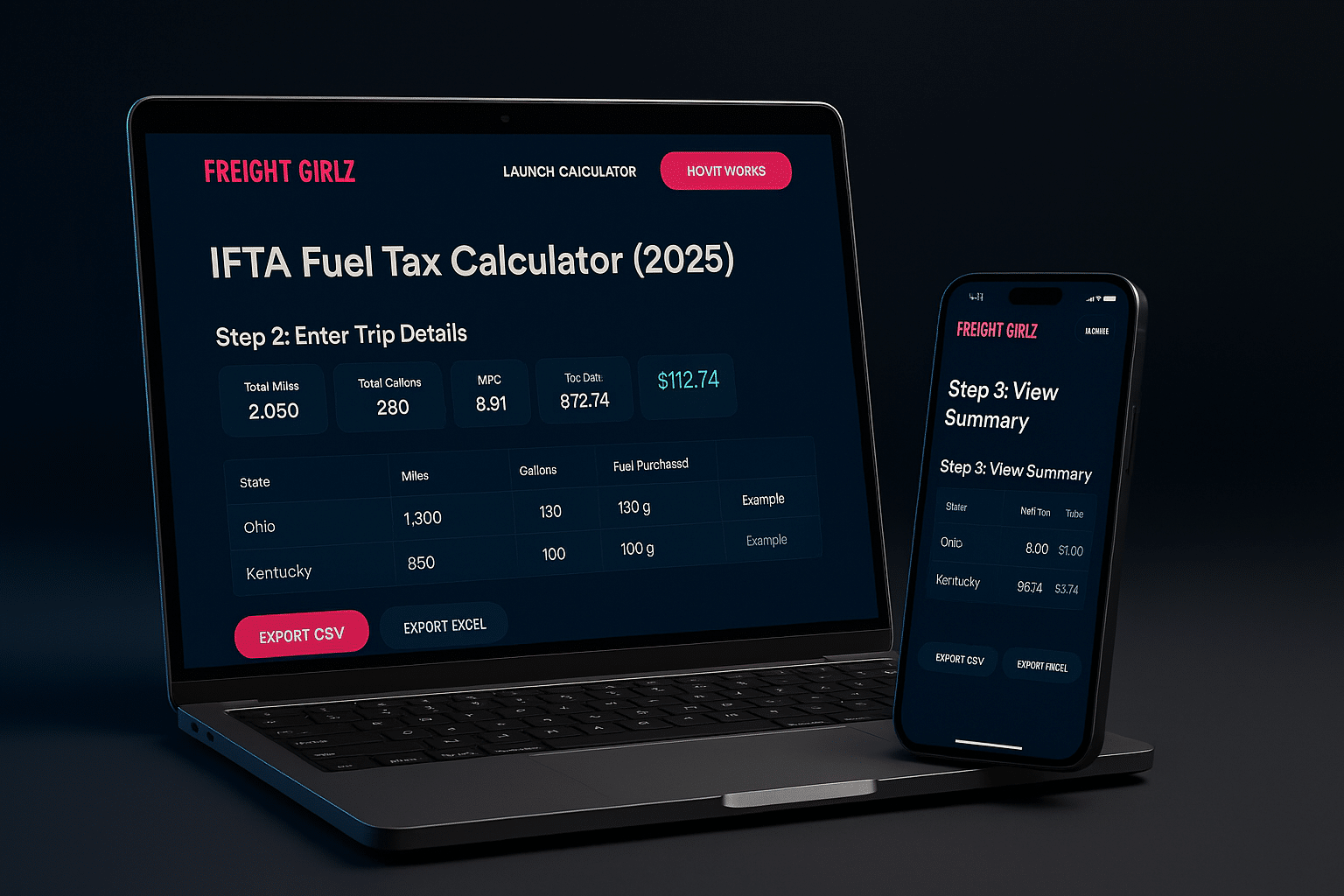

Enter your quarter totals, add jurisdiction miles + purchased gallons, and generate a clean tax due / credit summary using official quarterly rate tables.

IFTA Calculator — Quarter Filing

This IFTA calculator is available on desktop & laptop computers only (not mobile). For accuracy and easier filing, please open this page on a larger screen.

IFTA Calculator — Quarter Filing (US Miles & US Gallons)

Calculates IFTA tax due / credit by jurisdiction using your selected quarter’s rate table. All entries are in US miles and US gallons.

Step 1 — Quarter totals (required)

US miles + US gallonsTip: Enter quarter totals first. Fleet MPG = Total Miles ÷ Total Gallons. Jurisdiction taxable gallons are derived from that.

Step 2 — Jurisdiction line items

0 linesAdd one line per jurisdiction: miles traveled there + gallons purchased there (optional, used for credits).

| Jurisdiction | Miles | Purchased Gal | Fuel | Unit | Notes | Remove |

|---|---|---|---|---|---|---|

| Add a line to begin… | ||||||

Behind the scenes, this creates your rollups: taxable gallons, net gallons, and tax due/credit.

Step 3 — Summary (Tax Due / Credit)

—Formula: Fleet MPG = Total Miles ÷ Total Gallons. Taxable Gal = Jur Miles ÷ Fleet MPG. Net Gal = Taxable − Purchased. Tax = Net × Rate (negative = credit).

| Jurisdiction | Miles | Purchased | Taxable | Net Gal | Rate | Tax |

|---|---|---|---|---|---|---|

| Add at least one jurisdiction line to see tax due/credit. | ||||||

* If jurisdiction miles/gallons don’t reconcile to quarter totals, the Running Totals notice will warn you.

Internal Links

Everything around IFTA, paperwork, and weekly profitability.

- Document Management Store W-9, COI, BOC-3, fuel receipts, and IFTA logs in one place. ComplianceDocs

- Carrier Dashboard Upload BOL/POD and fuel/odometer entries to keep IFTA clean. PortalUploads

- Understanding Rate Per Mile Work RPM vs CPM into your IFTA fuel planning and weekly targets. RPMCPM

- Rate Negotiations Offset rising fuel costs with better RPM and accessorials. DetentionTONU

- Dispatch Questions—Answered Fast answers on paperwork, accessorials, and cross-border basics. FAQ

- Truck Dispatch Service Keep wheels turning while we help you stay audit-ready. Services

- Need help with IFTA entries? Ping our team—happy to sanity-check your totals before filing. Support

External Resources

Official IFTA, fuel prices, and related compliance links.

- IFTA — Official Site Program basics, jurisdiction links, FAQs, and publications. IFTAOfficial

- IFTA Jurisdiction Directory Find your state/province IFTA office, portals, and contacts. State Portals

- EIA Diesel Prices (U.S.) Weekly averages for planning fuel cost and RPM targets. FuelPlanning

- IRP — International Registration Plan Plates & cab cards across jurisdictions; complements IFTA. IRP

- FMCSA Portal Company records, biennial updates, and account access. FMCSA

- FMCSA Hours-of-Service Summary Plan fuel/mileage by legal drive windows. HOS

- IRS Form 2290 (HVUT) Heavy Vehicle Use Tax information & e-file options. Taxes

- Mileage & Routing Check Quick odometer sanity checks for trip sheets. Routing